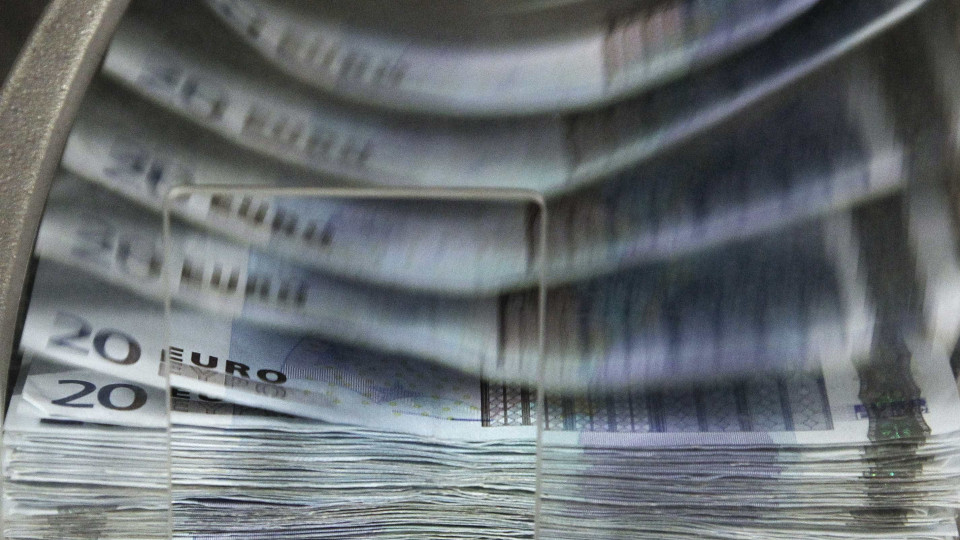

Banco de Portugal produced 265 million 20 euro notes in 2023

The Banco de Portugal (BdP) produced 265.8 million 20-euro notes in 2023 through Valora, a printer whose capital is entirely owned by the central bank, according to the Monetary Issuance Report of last year.

© Reuters

Economia Banco de Portugal

The report released today describes the central bank's activities in the scope of issuing notes and coins, the BdP explaining that the notes produced correspond to the quota of notes that it was assigned to produce under the agreement with the central banks of Austria and Belgium. Regarding the notes put into circulation by the Bank of Portugal, this value remained negative in 2023 (-24.7 billion euros) and fell 17.8% compared to the end of 2022. 6,372.7 million euros in notes left the Bank of Portugal and 10,113.6 million euros entered. The BdP justifies the negative net issuance with the growth in tourism (since tourists bring notes that are not absorbed by demand) and with the increases in interest rates by the European Central Bank (which discourages holding notes). However, the net issuance of coins continued to grow, having reached 791.6 million euros at the end of the year. Worldwide, the number of notes and the number of euro coins in circulation reached record highs at the end of 2023, with 29.8 billion notes and 148.2 billion coins, which for the BdP "confirms that cash continues to be the means of payment most used by citizens in the euro area". Nevertheless, it adds, the value of euro notes in circulation decreased for the first time since the introduction of the single currency, standing at 1.6 billion euros, 0.3% less than at the end of 2022, reflecting the increase in ECB interest rates. Regarding counterfeits, in 2023, 16,723 counterfeit notes and 3,197 counterfeit coins were withdrawn from circulation in Portugal. This data was already known and the BdP states that, in both cases, they correspond "to insignificant percentages of the number of genuine notes and coins in circulation". Last year, the BdP changed the rules for depositing and withdrawing notes and coins in its treasuries to encourage direct exchange between banks and cash-in-transit companies. The central bank states that this is why "withdrawals and deposits of securities at the Bank of Portugal fell sharply". Read Also: Household investment in Savings Certificates falls again (Portuguese version)

Descarregue a nossa App gratuita.

Oitavo ano consecutivo Escolha do Consumidor para Imprensa Online e eleito o produto do ano 2024.

* Estudo da e Netsonda, nov. e dez. 2023 produtodoano- pt.com